I sometimes try people here to get their opinion about property. I say "property prices in Singapore may fall in the future". And the answer I always get is the same "Property prices will never fall in Singapore". As you can see, I say "may" but I get an answer with "must". This is dangerous, not because what they think is wrong but dangerous because they think other scenarios are not likely and one does not need to consider them.

Just an example: This week I have realized that a colleague who bought a shoe-box unit for investment does not know that private property prices significantly went down just 2.5 years ago. He knew they went down in price but he did not know they went down something like 35 per cent. He was surprised when he saw the private property index of last 10 years.

Talking to him further surprised me more. The number of shoe-box units will triple soon and this will probably push the rents down. When the interest rates goes up the cash flow will most likely be negative. What will he do? He comfortable replied me "I then sell la." Welcome to Greater fool theory :)

There are some false assumptions about property buyers circulating in the world. First, many think buyers for owner-occupancy are not speculators. Well there are many who buy a "shelter" but a significant portion of them buy with the solid belief (not expectation) that property prices in Singapore will always go up. So you see many buying larger or more expensive units they can effort. Second many believe if someone is not a flipper, he/she is a sound investor. This also is a false assumption because again a significant number of property investors are highly uninformed about what they are going into. One of the most dangerous mis-information/assumption in the market now is the long term ultra low interest rates:

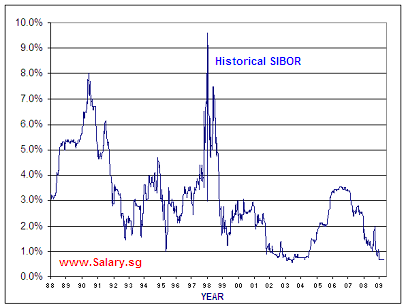

When I discuss this with the people many seems aware that rates will eventually go up. But the rates are so low now that they are unaware of the size of the increase and its effect to monthly cash flow. Many think 4 per cent is improbably high number and nearly all think that 4 percent is the highest interest rates can go up to. Actually 4 percent is the historical average of the interest rates so it is not impossible and also it is not the highest we have seen. Take a look at the graph below.

As you can see, interest rates has gone up to 9.5% in 1998! It may look temporary but the graph also depicts something terribly wrong in the financial markets. Except several years around financial crises, the interest rates are artificially kept low by Western money printing machine to repeatedly rescue their highly corrupted financial institutions. This had a price we see as a potential crisis now, huge sovereign debt in Western countries. As you can see in the news we may well be at the end of 20 years long "rescue wrong bets at all cost" years where FED repeatedly throws money to wrong bets by keeping interest rates artificially low. Yes, even the 4% interest rate is artificially low. And West does not look in shape to create more public debt to keep interest rates low.

Just an example: This week I have realized that a colleague who bought a shoe-box unit for investment does not know that private property prices significantly went down just 2.5 years ago. He knew they went down in price but he did not know they went down something like 35 per cent. He was surprised when he saw the private property index of last 10 years.

Talking to him further surprised me more. The number of shoe-box units will triple soon and this will probably push the rents down. When the interest rates goes up the cash flow will most likely be negative. What will he do? He comfortable replied me "I then sell la." Welcome to Greater fool theory :)

There are some false assumptions about property buyers circulating in the world. First, many think buyers for owner-occupancy are not speculators. Well there are many who buy a "shelter" but a significant portion of them buy with the solid belief (not expectation) that property prices in Singapore will always go up. So you see many buying larger or more expensive units they can effort. Second many believe if someone is not a flipper, he/she is a sound investor. This also is a false assumption because again a significant number of property investors are highly uninformed about what they are going into. One of the most dangerous mis-information/assumption in the market now is the long term ultra low interest rates:

"Current ultra-low SOR rates translate into just 2,823 SGD per month for 35 years, 1 million SGD loan. If rates go back to 2006 levels of 4 per cent the payment rises to 4,300 SGD monthly![1] In fact rates can go up further since current ultra-low rates due to USA money printing machine will most probably result in ultra-high rates in the near future. Combine this with rental decreases, one can find him easily in red for years."

When I discuss this with the people many seems aware that rates will eventually go up. But the rates are so low now that they are unaware of the size of the increase and its effect to monthly cash flow. Many think 4 per cent is improbably high number and nearly all think that 4 percent is the highest interest rates can go up to. Actually 4 percent is the historical average of the interest rates so it is not impossible and also it is not the highest we have seen. Take a look at the graph below.

|

| Historical Sibor Source: www.salary.sg |

No comments:

Post a Comment