Pretty women are waiting for their online prince in this web site but the online prince should first fork out USD 100 (SGD 120) to message and secure a date and meet her. The formula is simple: "no money no honey". "It may be materialistic for a woman to find a rich man, or shallow for a man to flaunt his wealth but that's the way the world works" say Brandon Wade, 41 years old Singaporean-born US citizen.

He has converted his idea to an online business, WhatsYourPrice.com. He says his web site has 120,000 (240 members in Singapore) registered members worldwide and is "already profitable". He is also the founder and CEO of the controversial website SeekingArrangement.com where rich old men, called sugar daddies could seek a date with young pretty girls.

In this online dating website, you can call it e-bay of dating, users can buy or sell the opportunity of going out on a first date. The site guarantees its members a first date and a possible long term relationship. Motto of the web site is of course "everyone has a price". Man needs to fork out 100 USD for a first date with a member who lists herself in the "attractive category". Once the money - called wink in the site - is accepted, the site provides e-mail contacts two both parties and they can negotiate the details of their first step to a meaningful, fullfilling relationship or one night bang and go adventure.

"If users find someone they are interested in, they make them an offer. The highest bid Wade has seen was from a man offering a woman $1,000 if she would go on a date with him.

Before the date begins, the bidder must hand over half the cash payment. The remainder is paid at the end of the date. The bidder must also pay the cost of the date. The site collects 5-10 percent of the bid amount as a fee "to unlock the gate to communication" between the two. There is no payment for future dates.

The lowest bid allowed is $10. This does not appear to deter women "if the guy is attractive," Wade says. "There's quite a lot of $10 dates."

Wade says he started the site because of his own dissatisfaction with online dating sites. Before launching it, he took two focus groups of 20-30 women, showed them pictures of "average looking guys" and asked them if they would go out for a two hour coffee date. Most said no. What if they guy was willing to pay you for a chance to prove himself? Eventually, everybody said yes, if the price was right."

Source : Guess which O.C. men pay most for dates

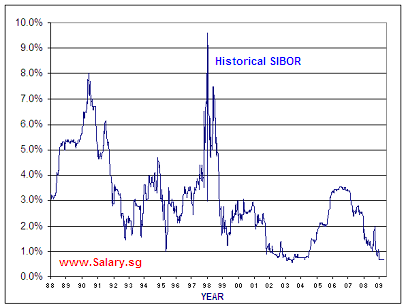

Can a price be put on love? Can you buy love? "Looks and money are important factors motivating two persons to move to first base." says National University of Singapore sociology professor Tan Ern Ser.[1] "Women, in particular, tend to disregard men whose social status or income is so low. So, at least to some extent, people have long been putting price on love" says Singapore Management University psychology professor Norman Li.[1] What they say are universal facts but these facts are more severe in Asia where a man without a handsome level of income can virtually forget about having a girlfriend or wife. This is one of the main reasons we have so many "foreign brides" in Korea, Taiwan, Hong Kong and Singapore. In mainland China this has even been proudly presented with some money minded chinese women.

[1] - The Straits Times - Can Buy Me Love?

He has converted his idea to an online business, WhatsYourPrice.com. He says his web site has 120,000 (240 members in Singapore) registered members worldwide and is "already profitable". He is also the founder and CEO of the controversial website SeekingArrangement.com where rich old men, called sugar daddies could seek a date with young pretty girls.

In this online dating website, you can call it e-bay of dating, users can buy or sell the opportunity of going out on a first date. The site guarantees its members a first date and a possible long term relationship. Motto of the web site is of course "everyone has a price". Man needs to fork out 100 USD for a first date with a member who lists herself in the "attractive category". Once the money - called wink in the site - is accepted, the site provides e-mail contacts two both parties and they can negotiate the details of their first step to a meaningful, fullfilling relationship or one night bang and go adventure.

"If users find someone they are interested in, they make them an offer. The highest bid Wade has seen was from a man offering a woman $1,000 if she would go on a date with him.

Before the date begins, the bidder must hand over half the cash payment. The remainder is paid at the end of the date. The bidder must also pay the cost of the date. The site collects 5-10 percent of the bid amount as a fee "to unlock the gate to communication" between the two. There is no payment for future dates.

The lowest bid allowed is $10. This does not appear to deter women "if the guy is attractive," Wade says. "There's quite a lot of $10 dates."

Wade says he started the site because of his own dissatisfaction with online dating sites. Before launching it, he took two focus groups of 20-30 women, showed them pictures of "average looking guys" and asked them if they would go out for a two hour coffee date. Most said no. What if they guy was willing to pay you for a chance to prove himself? Eventually, everybody said yes, if the price was right."

Source : Guess which O.C. men pay most for dates

Can a price be put on love? Can you buy love? "Looks and money are important factors motivating two persons to move to first base." says National University of Singapore sociology professor Tan Ern Ser.[1] "Women, in particular, tend to disregard men whose social status or income is so low. So, at least to some extent, people have long been putting price on love" says Singapore Management University psychology professor Norman Li.[1] What they say are universal facts but these facts are more severe in Asia where a man without a handsome level of income can virtually forget about having a girlfriend or wife. This is one of the main reasons we have so many "foreign brides" in Korea, Taiwan, Hong Kong and Singapore. In mainland China this has even been proudly presented with some money minded chinese women.

[1] - The Straits Times - Can Buy Me Love?